The war between Russia and Ukraine has raised questions about the impact on the economies of other countries with which Moscow and Kyiv have economic and trade relations. In addition, against the background of Western sanctions against Russia, the relevant issues include difficulties the economies of countries with which Russia has economic partnerships may face, the possible sharp depreciation of the Russian ruble affecting the income of trading partners, as well as other such issues.

Faktyoxla Lab. has investigated the impact of the war and sanctions on the economy of Azerbaijan, a partner of both Russia and Ukraine.

First of all, it should be noted that the Russian Federation ranks third in Azerbaijan's trade turnover. Russia is Azerbaijan's main import partner and the largest exporter of non-oil products. Azerbaijan accounts for 45% of Russia's trade in the South Caucasus. The mutual trade turnover between the two countries by 2021 amounted to $3 billion. Azerbaijan exported $920 million worth of goods to Russia. About $850 million of these products accounts for non-oil exports, and Russia ranked first in the non-oil exports last year. In particular, the country has a leading position in the market of agricultural exports. At the same time, industrial products are exported from Azerbaijan to Russia, and 50% of plastic and rubber products, which account for 15% of non-oil exports, account for the Russian market. (Source)

The volume of products imported from Russia to Azerbaijan in 2021 amounted to $2 billion. Most of these products are food products. The main special place in the composition of food products is grain and wheat, the annual volume of which is about $295 million. In addition, forest and wood materials, mineral fertilizers, rolled steel and other industrial materials, chocolate and chocolate products, butter and vegetable oils, medicines and medical supplies, alcoholic beverages, mineral and carbonated water, paper and cardboard products, sanitary hygienic means, other products are imported. (Source)

It should also be noted that the prices for food and industrial and other products imported by Azerbaijan from Russia are cheaper than similar products offered by other world market countries.

Economic ties are also reflected in mutual investment and increased joint business activity. There are 950 companies with Russian capital in Azerbaijan, which is 10% of all companies with foreign capital in the country.

So far, Russia has invested $6.3 billion in Azerbaijan’s economy, while Azerbaijan has invested $1.2 billion in the Russian economy. Some $5 billion of Russia's investment in the country was directed to the oil sector, and $1.3 billion to the non-oil sector. Azerbaijan's investment in the neighboring country is almost entirely in the non-oil sector. (Source)

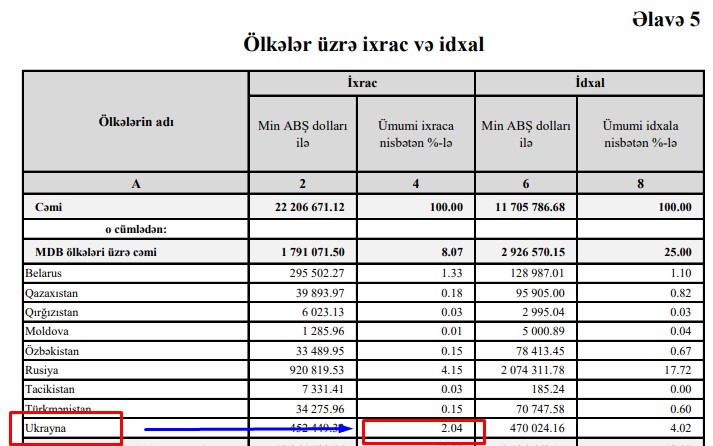

Ukraine ranks second among the former Soviet Union countries in terms of trade relations with Azerbaijan, after Russia. In 2010, it even surpassed Russia in terms of exports. In 2021, the trade turnover between the two countries amounted to $920 million. Azerbaijan exported $452 million worth of goods to Ukraine and imported $470 million worth of goods. (Source)

Goods imported from Ukraine are tobacco products, beef, cigarettes, poultry and its by-products, butter, other dairy oils and pastes, medicines, live cattle, chocolate and chocolate products, sugar confectionery, margarine, food, etc.

Azerbaijan exports fresh fruits and vegetables, oil and oil products for jet engines, kerosene, lubricants to Ukraine. (Source)

SOCAR has an extensive energy and fuel network in Ukraine. This country has a fuel sales complex and gas stations. Azerbaijani construction companies are implementing projects in Kyiv and other cities, as well as oil and petrochemical enterprises, so that about 100 companies operate in both countries.

It is clear from these facts that both Russia and Ukraine are close trade partners of Azerbaijan in the region, and, of course, these undesirable events between the two countries also concern Azerbaijan. At the very least, the war will undoubtedly affect the previous harmony in the economic and trade relations of the two countries, as well as transport and logistics, delivery of goods and services, and so on, creates difficulties in securing issues. In particular, it is expected that Ukraine will stop exporting goods not only to Azerbaijan, but also to all trading partners. In any case, this will lead to a decrease in Azerbaijan’s foreign trade turnover with Ukraine. Restrictions on transport links will also affect trade cooperation. Of course, the scale of these effects will depend on the duration of the war. From this point of view, this trade deficit can be compensated by the goods exported from Azerbaijan to Ukraine and imported from Ukraine to Azerbaijan for some time.

However, restrictions on trade in general won’t pose a problem for Azerbaijan's total imports and exports, especially to a level that will have a significant impact on export earnings. That’s because Ukraine's share in Azerbaijan's $34 billion trade turnover is only 2.2 percent. (Source)

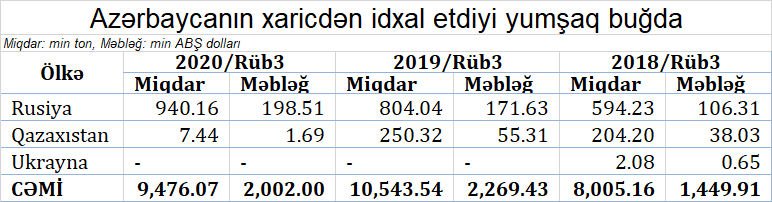

As for Russia, the situation is different here. Russia's share in Azerbaijan's total trade turnover is more than 9 percent, and this figure is not small. Most importantly, Russia accounts for 45% of Azerbaijan's food imports in a year. Of 1.4 million tons of grain imported by Azerbaijan annually, 1.1 million tons account for Russia. Therefore, it is more expedient for economic relations with this country to remain in harmony.

But one point needs special attention. If Azerbaijan earns $100 in foreign trade from Russia, it pays $300 in return. Russia earns $200. In other words, in a $3 billion trade, Azerbaijan sells $1 billion worth of goods and buys $2 billion worth of goods. From this point of view, the depreciation of the ruble is a kind of benefit for Azerbaijani importers. Because they buy goods from Russia in cheap rubles, their income may increase.

It must be acknowledged that the cheap ruble won’t be beneficial to Azerbaijani exporters, as about $900 million worth of agricultural products are exported to Russian markets annually, and the main income of Azerbaijani local entrepreneurs is the markets of this country. The sale of the Russian ruble, which is currently depreciating sharply due to international sanctions, prevents them from earning their previous income. It is true that Russia's share in the foreign exchange inflows to Azerbaijan is not so high, only 4 percent. In other words, the sanctions imposed on Russia will not have a significant impact on the volume of currency inflows to Azerbaijan, but may reduce revenues in the non-oil sector.

At the same time, the amount of remittances earned by 2 million of Azerbaijani compatriots working in Russia and sent to Azerbaijan may decrease. Both the decline in their income and the depreciation of the ruble will reduce the amount of remittances. As for money transfers from Russia to Azerbaijan, in the near future, in addition to the use of national currencies in mutual settlements, it may be possible to make transfers without SWIFT, ensuring the compatibility of payment systems, including joint services in bank cards. Also, the development of direct correspondent relations between the banks of the two countries can provide personal financial communication with the banks. That is, it is possible to exchange money through the national payment system "Mir", Russia's multimillion-dollar payment system. (Source)

It should be kept in mind that some economists try to describe the maintenance of the Russian ruble, which has a very small share in the assets of the Azerbaijani State Oil Fund, as almost a tragedy, as if the current state of the ruble will lead to a complete devaluation of the Oil Fund’s investment portfolio.

First of all, it should be noted that the investment portfolio of the State Oil Fund is quite flexible and of multi-currency in nature, the weight of the ruble in the investment portfolio of $45.5 billion is only 0.5%. The main currencies in SOFAZ’s investment portfolio in 2021 are the dollar, the euro and the pound sterling, and it is known what a reliable and important currency they are. In 2021, the Fund's return on currency management was about 3.2%, with the main share of total return being the dollar and the euro. In other words, the share of the Russian ruble in the difference due to exchange rate fluctuations in general is extremely weak. Shares, gold and real estate investments in the fund's investment portfolio are 3%, and the share of real estate in Moscow in portfolio returns is still very low.

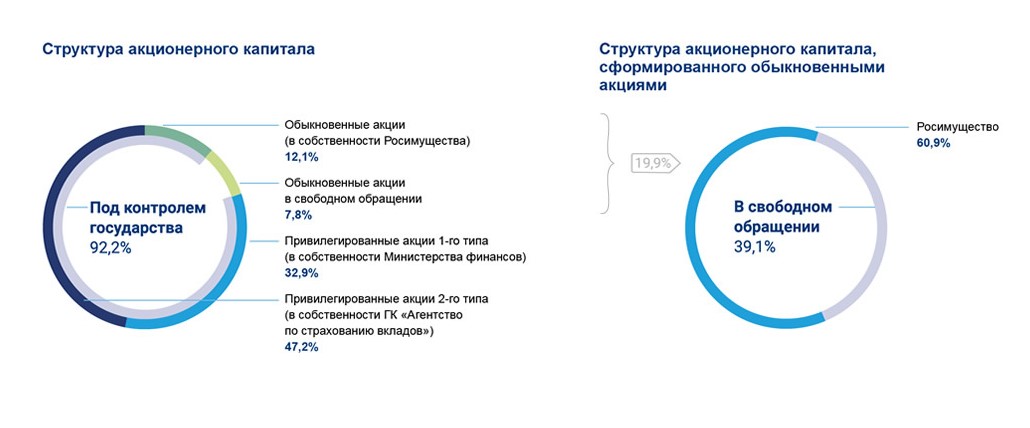

It should also be noted that the Oil Fund has changed its investment policy over the past two years in line with global market conditions and prefers asset management in the context of lower risk and lower price volatility, taking into account risk factors. In this regard, SOFAZ’s Plan B is never forgotten, and the Fund is well aware that those funds held in rubles will cause losses, adjustments are made every quarter of the year in accordance with the flexible investment policy. As for SOFAZ’s shares in Russia's VTB Bank, the Fund has a 2.9% stake in the bank, and the stake was acquired a few years ago, when the world's largest financial institution was a shareholder in VTB Bank. Because at that time, VTB Bank was the largest financial institution in Europe, and large shareholders and financial conglomerates competed for 39% of the Bank's sold shares. According to the authorized capital, shareholders of Kazakhstan, Germany, Italy, the UK and Cyprus acquired shares in VTB, Russia's first bank. (Source)

The State Oil Fund of Azerbaijan (SOCAR) currently retains the authority to sell its shares in VTB Bank.

Some "experts" claim that the current conflict will lead to higher grain prices, given the special share of Russia and Ukraine in the supply of wheat in the region. Russia will increase the price of wheat sold to many countries, including Azerbaijan. Azerbaijan imports 1.2 million tons of wheat a year from Russia alone, or 80-55 percent of imports. Currently, Russian wheat has the cheapest price for Azerbaijan. (Source)

The opportunities for economic cooperation between the two countries are great, and there are no problems with wheat imports. Because the economic documents provide for concessions and free trade in mutual trade.

It should also be taken into account that, first of all, since the war did not take place in Russia, there will be no problems with the cultivation of grain in this country, and wheat production is not expected to decline this season. As a result, Azerbaijan will be able to buy wheat from Russia under the same quota as before. Second, the increase in the price of wheat to be imported to Azerbaijan due to mutual agreement is not expected.

It should not be forgotten that Azerbaijan has always managed to neutralize the losses under its "Plan B" against various scenarios arising from global processes. For many years, Azerbaijan has continued its path of sustainable development by restrained, alternative and adequate response measures to force majeure and processes taking place at the international level. At the same time, it has a strategic concept that reflects the national interests, avoiding situations that are determined, balanced and detrimental to the national interests of any country in the face of various adverse events in the region and the world. This has been witnessed in recent years during all global economic crises and political conflicts. During the sanctions against Iran, which is in the top five in the trade turnover of Azerbaijan, the dynamics of economic relations remained stable, and import-export and other economic processes with Iran did not seriously affect Azerbaijan.

Thus, although the war between Russia and Ukraine has had some impact on the countries of the region, including Azerbaijan, the impact of international sanctions on the Azerbaijani economy may be very low.